Demand drivers for genetic improvement

Drivers

INCREASING DEMAND FOR ANIMAL PROTEIN

The global population is expanding and urbanising, and seeking a more varied and nutritious diet. This is driving increases in consumption of pork, milk and beef, which are forecast to grow by 1–2% p.a. in the next decade.

NEED TO PRODUCE FOOD MORE SUSTAINABLY

Competition for resources, such as land and water, and the need to reduce greenhouse gas emissions to tackle climate change, puts pressure on farmers to become more efficient through the use of technology and genetically superior animals, which are demonstrated to be more sustainable.

CONSUMERS ARE DEMANDING BETTER PRODUCTS

Consumers are increasingly demanding healthier and more sustainable products, which are produced with a focus on animal welfare, traceability and reduced drug use. This increases farmers’ demand for genetically superior breeding animals, which are naturally more resilient and sustainable.

FARM CONSOLIDATION AND TECHNOLOGY ADOPTION

Progressive farmers, who are more open to new technologies and measure performance in more detail, are consolidating the sector. They understand the economic and sustainability benefits of genetically superior animals and optimised breeding strategies, such as combining the use of sexed dairy and beef semen on dairy herds to maximise profit.

Trends in our market

PORK

Production

Pig production is largely technified with progressive producers employing similar production systems globally. To stock a farm, producers typically acquire breeding pigs and semen from specialist genetic improvement companies or captive breeding programmes. Thereafter, they periodically acquire semen so they can benefit from the latest and best-performing genetics.

Disease poses a significant risk to pig producers, who rely on biosecurity protocols and health products to manage the threats such as African Swine Fever and PRRSv, which causes billions of dollars of damage to the industry annually.

China is by far the world’s largest pork market and pigs there were historically produced mainly in small ‘backyard’ farms. In 2018, an outbreak of African Swine Fever caused the national sow herd to decline by about one-third. The resulting shortfall in pork drove the expansion of large-scale technified pig production, further aided by the legislative drive to professionalise the sector. Today, the top 50 producers control around a quarter of the sow herd in China.

Genus Opportunity

- Maintain our genetic lead by driving genetic improvement faster than competitors and customers’ internal programmes

- Ensure biosecure supply of breeding stock and semen for progressive producers in all key markets

- Drive market share gains via strategic partnerships with major producers

- Make China a ‘home market’, with local nucleus herds, supply chain and superior customer service

- Obtain approval for and launch our gene-edited PRRSv-resistant pigs, and explore technology solutions to other diseases

BEEF

Production

Beef is produced in a variety of systems globally and from many breeds, using both artificial insemination and ‘natural service’. Beef animals are often traded multiple times between birth and processing.

In the US, beef is mainly produced from pure-bred beef animals bred naturally from bulls on farm or sourced from the open market. A modest but growing portion of beef cattle is produced by breeding dairy cattle with beef semen (Beef x Dairy). Beef x Dairy uses ‘surplus’ dairy breedings to produce high-quality beef animals that are more consistent than those from pure-bred beef systems.

In Brazil, beef is mainly produced from pure-bred ‘tropical’ beef cattle suited to local conditions, but tropical cattle are increasingly being cross-bred with semen from European breeds. The resulting cross-bred calves have better meat quality and growth rates than tropical animals, and are more heat tolerant than European breeds.

Genus Opportunity

- Demonstrate the superiority of our proprietary beef genetics across the value chain through trials and partnerships

- Build on our product leadership in beef semen for dairy and tropical cross-breeding

- Develop naturally more resilient cattle, through genomic selection and gene editing technologies

- Progress pull-through demand partnerships to underpin demand for Beef x Dairy genetics

MILK

PRODUCTION

Milk production systems vary due to genetics, technification and the local environment, resulting in the average US cow producing over ten tonnes of milk annually compared with two tonnes in India. Dairy production is fragmented, but progressive farmers are consolidating. Average herd size in the US has grown by 77% over ten years3, and China’s dairy sector has significantly consolidated in recent years with the top three producers controlling almost 20% of production.

Historically farmers selected breeding animals based on their progeny’s performance. However, in 2008, genomics enabled the selection of animals at birth from their DNA. Leading studs such as ABS responded by consolidating the ownership of elite genetics and transitioning from purchasing bulls to proprietary breeding programmes. Between 2008 and 2023, the number of breeders featured in the top bull rankings fell from 107 to 30.

Sexing technology use has grown rapidly, enabling farmers to produce herd replacements from their best cows with fewer breedings, given the ~90% chance of a female. Other animals in the herd are increasingly bred with beef semen to produce a high value cross-bred beef calf. The proportion of ABS’s sales to US dairies consisting of sexed and beef genetics has grown from 16% to 78% between FY16–FY23.

GENUS OPPORTUNITY

- Driving genetic improvement faster than competitors

- Drive the adoption of our sexed and Beef x Dairy genetics amongst dairy farmers, to maximise their profitability

- Grow our presence with progressive industry consolidators globally

- Deploy our proprietary sexing technology with partner studs, delivering competition, value and sustainability to the industry

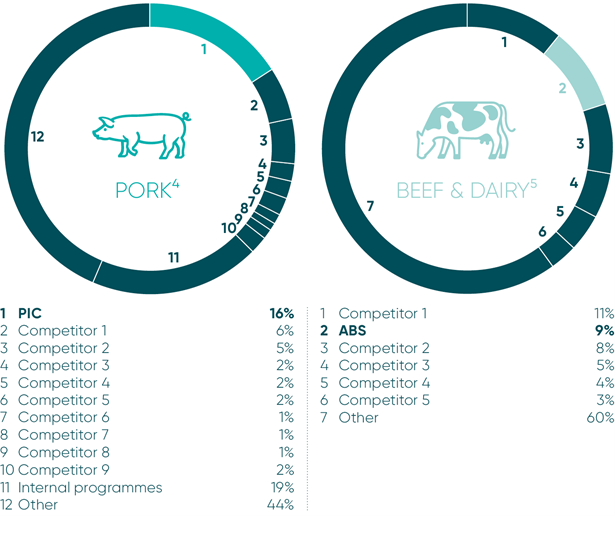

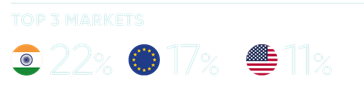

Position

Genus is a leading player in global porcine and bovine genetics markets, serving many of the Top 100 pig producers and dairies globally. Investment in our proprietary genetic programmes has delivered world-leading products in all our species, validated by indices and on-farm trials. Genus is also recognised as a global leader in genomic, gene editing and sexing technologies.